Client

BPI – Bank of the Philippine Islands

Date

2018

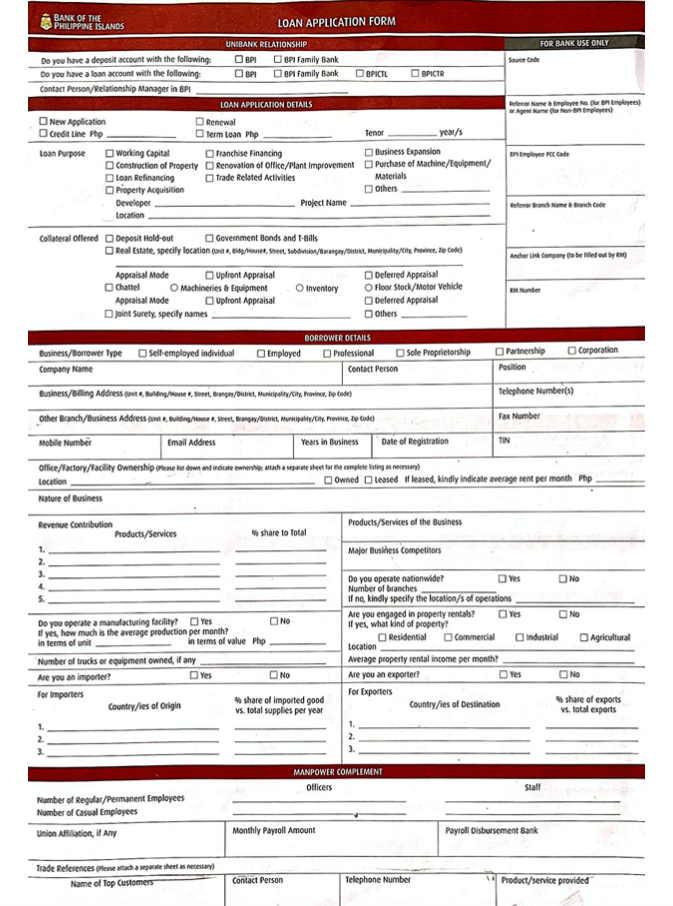

The BPI’s loan application system for enterprises was still linked to a physical dimension (one on one interaction and paper forms): wasteful and inefficient generated excessively long response times.

The bank had the need to review the business model and service delivery.

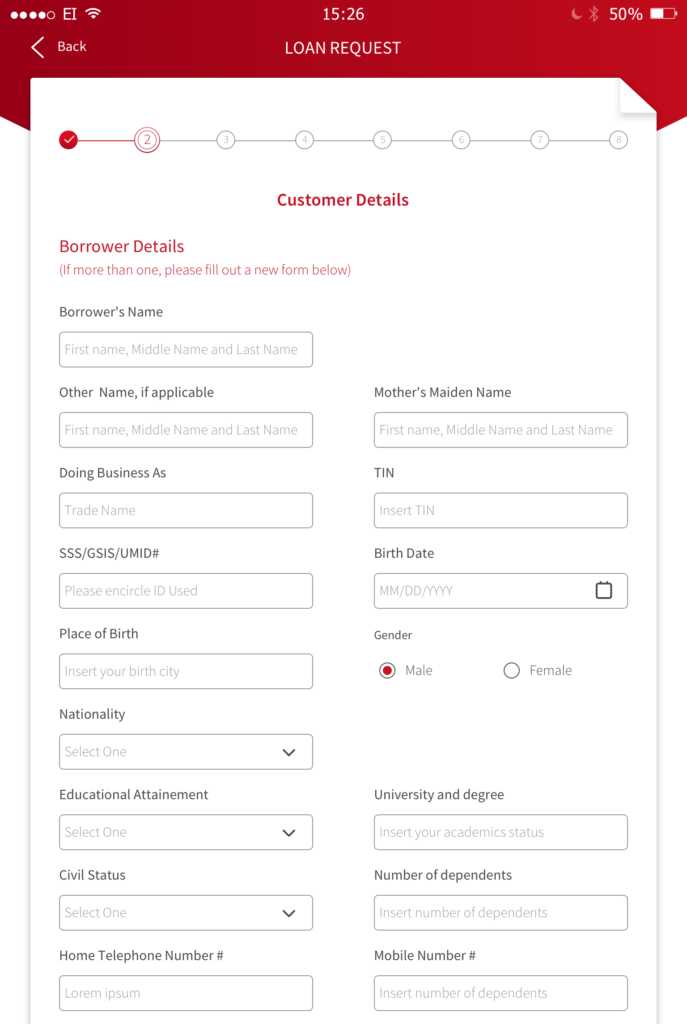

I worked together with the bank to study the needs of stakeholders and customers in order to improve the process and design a new Mobile Lending system, digitize practices and trigger a gradual transformation process.

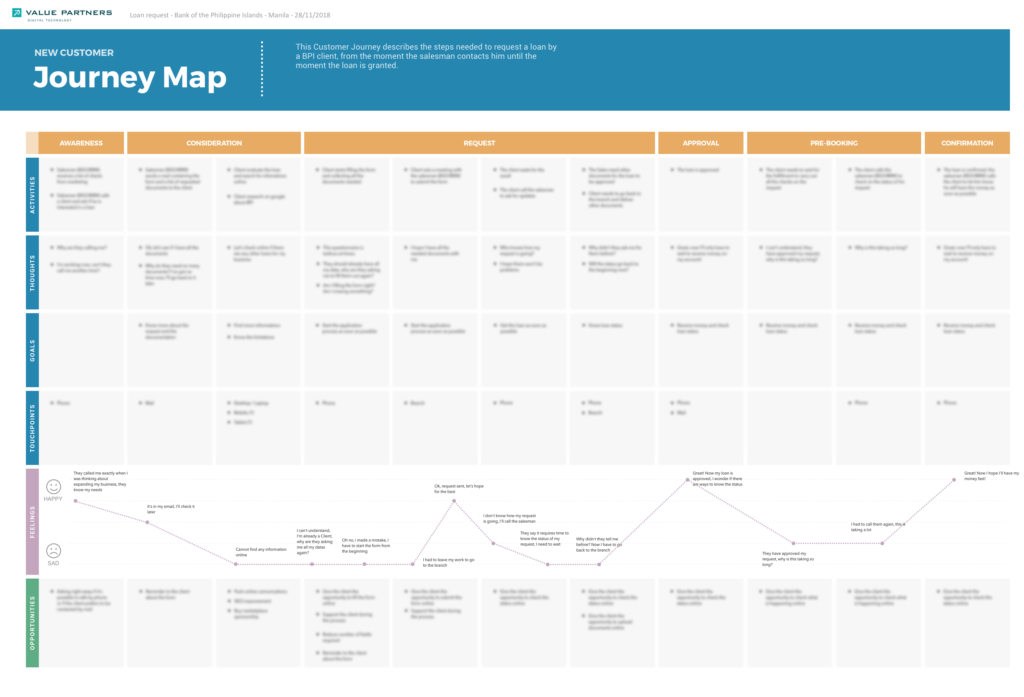

All internal processes have been mapped from one to one interviews with all the stakeholders in order to create and define a complete customer journey map.

Using this map we were able to understand what the pain points were (both of the loan operators and of the end users) and to design a new customer journey based on a more digital approach.

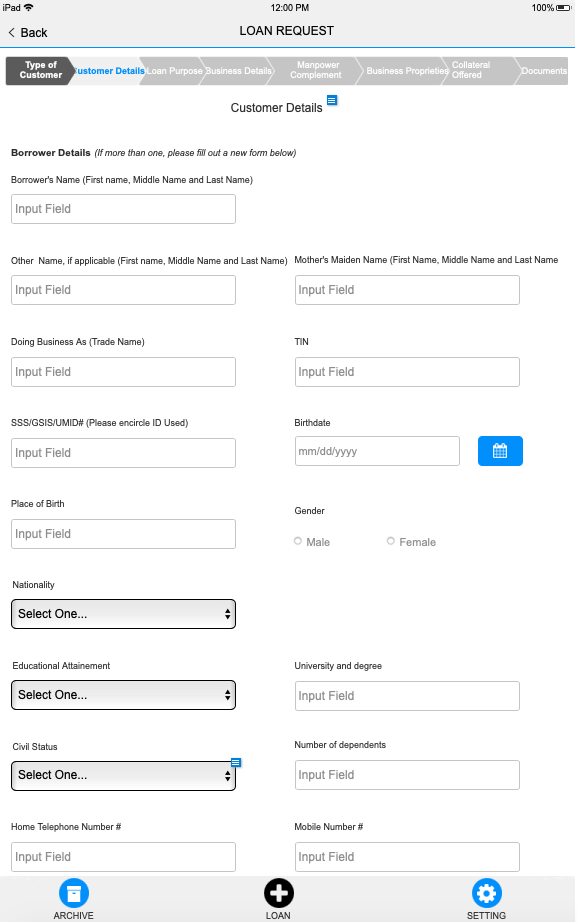

Starting from the results shown in the customer journey map and from the actual PDF the Bank uses to gather informations my team designed the wireframes of the new mobile application for the loan request and, after several verification and approval steps, the final UI was delivered to the client.

Deliverable

Interview results

Customer Journey

Wireframe

Software

Sketch

Axure